They say to never trust an anonymous blogger on the internet. And I am an anonymous blogger. I have my reasons for remaining anonymous, and those reasons don't matter. Can you really trust articles on Bloomberg or Wall Street Journal any more than an anonymous opinion? All I ask is to debate the content of my message. Not who I am or my motivations. If you agree with what I say and think that it's in-depth, quality and truthful work, then make sure to share this on every retail channel available to you. Reddit, Discord, Stocktwits, Twitter, Telegram, Whatsapp, Tiktok and wherever else. I have just added a follow option at the top left for those who want to be notified when more blogs come out.

Longeveron Inc. (LGVN) has been a massively hot stock since the company received good news from the FDA last week. The stock closed at $2.92 on November 17, the day before the news shot it up as high as over $30 in post-market trading on Monday and pre-market trading this morning. iSpecimen Inc. (ISPC) is LGVN's twin as it shot up after announcing that it was Selected by U.S. Government and Private Researchers to Supply Critical Human Biospecimens for Advanced Phase of COVID-19 Research.

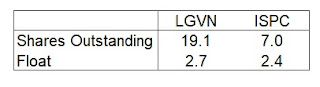

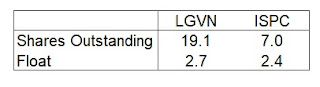

ISPC can be considered LGVN's twin because both of them were recent IPOs in the health care space over the past year, plus they have very similar floats:

ISPC has a smaller market cap, and I think it's a better deal right now because its news relates to actual revenue generating activities with contracts from government and private researchers for the fight against COVID-19.

But the real opportunity here is how each stock trades and how that trading pattern on LGVN before it broke out to $30 matches ISPC's forming pattern very closely.

Day one:

On November 18, LGVN opened at $3.72, hit a high of $8.90 but actually performed quite weak in afternoon trading and closed at $6.87, up 135% on the day. However, in the after hours market, the stock shot up to over $10.

On November 22, ISPC opened at $11.39, hit a high of $12.77 but also performed weak in the afternoon, dropping to $8.88 and closing up 80% on the day. However, in after hours trading, it shot up over $15.

On both of those days, shorts, trolls and other people who think they are smarter than they really are talked non-stop about equity offerings. Neither stock announced an equity offering and the results show in the stock price the next day.

Day two:

On November 19, LGVN opened at $11.81, a 72% spike from the previous day's close. It hit a high of $14.75 but ended up selling off the rest of the day to close at $10.03

Today, ISPC opened at $16.84, a 90% spike from the previous day's close. It hit a high of $18.50 but pulled back as low as $11.20 before rebounding to close at $13.19.

Day three:

On November 22, LGVN opened down at $8.71, but saw continuous buying throughout the day to close at $28.20.

Is this the fate of ISPC tomorrow? So far they have been trading very similarly. They both have similar floats, are recent healthcare IPOs and have had great news recently. ISPC has the advantage of generating operating revenues right now while LGVN's revenues have been from grants and clinical trials. ISPC's current news creates expectations that it will have good revenue growth right now, while LGVN's revenues will come in the future assuming successful clinical trials and FDA approval of a marketable drug.

HOWS THAT WORKING FOR YOU PUMPTARD

ReplyDelete