Three Small Cap Stocks To Watch This Week

The small cap space has been heating up recently, with random stocks popping 300% or more out of nowhere in one or a few days. There are three basic categories of stocks that are popping:

1. Low float/low volume multi-dollar stocks.

2. Penny stocks trading well below $0.50 and sometimes below $0.10

3. De-SPACs that have fallen way below their initial $10 merger value.

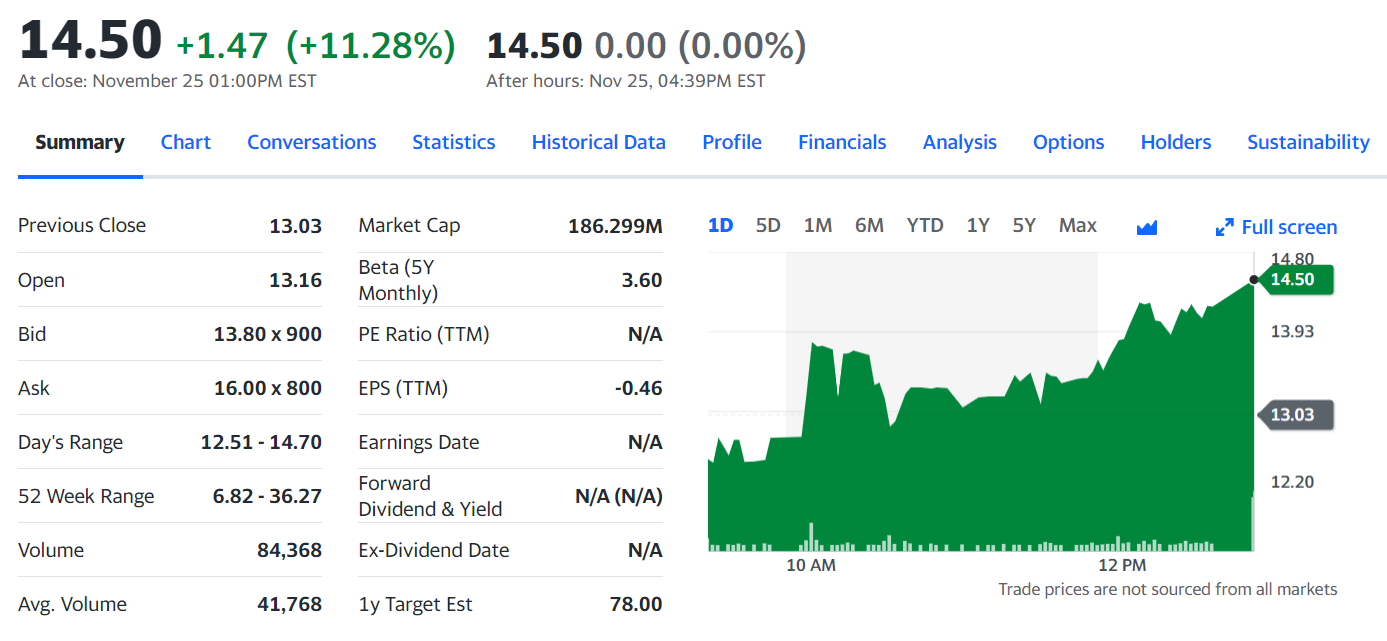

The stock that we are recommending to keep close watch on in the first category is Greenwich LifeSciences, Inc. (GLSI). It's a former major runner that went from $5.20 to $158 in one day in December 2020 after excellent data on its mid-stage breast cancer immunotherapy. The stock has been creeping up on low volume. It rose 20% on 156,000 volume last Wednesday and followed that up with another 11% gain on 89,000 volume on Friday. It picked up steam in the final hour, and if not for the early 1:00pm close, the stock might have broken out to $20.00.

GLSI has 12.9 million shares outstanding, but only a 3.6 million float. It has 186,000 in short interest, fairly high given the small float and small daily volume.

This sudden surge on light volume could be indicative of a news leak similar to what we saw in December 2020. At a minimum, the trading momentum should continue this week on hype. It's rare to see a continuation of a trend for the second day without it carrying to the third and fourth days. Usually a low volume pump like the one seen on Wednesday is followed up with giving back most of those gains the next day. When a stock has bucked that trend like GLSI has, chances are the bullish move will continue,

Last week was a wild one for penny stocks, with Cosmos Holdings Inc. (COSM) leading the way. COMSovereign Holding Corp. (COMS) picked up massively in volume and a bit in price last week as well, very likely as a similar symbol sympathy play. Some people will laugh this reasoning off, but a trade is a trade, no matter how stupid the reasoning. AMC Networks Inc. (AMCX) was a major benefactor of the meme stock movement on AMC Entertainment Holdings, Inc. (AMC) back in early 2021, so this mistaken or similar identity sympathy play is real.

COMS has 161.2 million shares outstanding and 70.6 million float. Volume for the last three trading days has been 75 million, 347 million and 64 million respectively. There is a substantial 6.8 million short interest, which has a pretty good chance at accelerating a squeeze given the unique situation. COMS short interest was 3.5 million as of mid-October. So COMS shorts are a mix between those who have shorted at very high prices and are sitting at massive gains, and those who have started a short position at sub-10 cents. The people in the former group already sit at massive profits. It really doesn't make a lot of sense to wait it out for the final 10% or 15% watching COMS go to zero when instead they can cash out their 85% or 90% gain and use the margin to find a better short candidate. Therefore these people really don't care so much whether they cover at 6 cents or 10 cents or 20 cents. The other half of the shorts have a legitimate chance of getting squeezed because they are in at a low price. Presumably hoping for bankruptcy or a reverse split followed up by a major financing.

Like any stock trading at $0.08, one can assume that COMS has intense financial difficulties and is at risk of dilution or bankruptcy. Here is the kicker for COMS - it can't do a reverse split until it gets approval from shareholders. The AGM is set to be held on January 18. For which the company is seeking approval to do a reverse split in the 1-for-100 range. But until then, traders are safe from a reverse split announcement or dilution. Instead of diluting, the company has been issuing debt. That increases the bankruptcy risk in the long term if the financials don't improve, but also greatly decreases the dilution risk in the short term, which is what is of greatest concern for traders. The new CEO also released a letter outlining how he will get the company on the right track. So we could see good news of financial improvement at any time.

Given the increase in volume, unique situation which makes reverse split and dilution risk basically nil over the next several weeks and low price compared so a more major runner like COSM, COMS makes an ideal penny stock trade to watch for this week.

Our final pick in the de-SPAC category is FOXO Technologies Inc. (FOXO). This stock has absolutely cratered, never coming close to $10 post-SPAC since it listed in September. There has been an uptick in trading interest since November 18, highlighted by a 48% gain to $0.72 on November 22 after hitting its 52-week low on the prior day. It has pulled back to the $0.60's since, after releasing a Q3 that was light on revenue and showed a net loss. FOXO has 31.2 million shares outstanding and an 18.8 million float. This is fairly small for a SPAC, and we think it makes an ideal candidate for a follow up to the bounce it had on the 18th.

Comments

Post a Comment