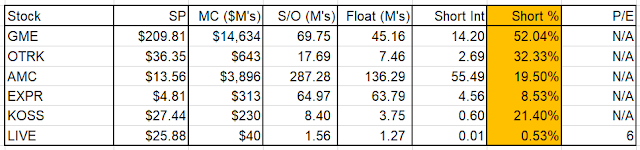

Short Squeezes Heading Into Option Friday - GME, AMC, EXPR, OTRK, KOSS, LIVE

On Friday it's the monthly triple witching day, where the most extensive list of options hit their expiry. On February 19, it signaled the bottom for GME and near the bottom for most of the meme stocks. While put option holders won that round. these stocks have done nothing but rise since. We expect this Friday to be a big win for the call option holders and bulls, as the rising market and rising prices of these stocks in particular are putting pressure on them. This is a chart of the share float and short interest of the top meme stocks and short squeeze candidates. These stats are posted exactly as is from Yahoo Finance and we're aware that the short % doesn't equate to the short interest divided by float:

GME remains the top target with a short % of 52%. OTRK comes in at #2 with 32% and remains our prime target for a massive short squeeze based on this high short interest and gap in the chart currently attempting to be filled:

OTRK had a huge gap down from the $50's to the $30's on March 1 after announcing that it lost its largest client Aetna. Since then it has marched back up and is now above the price of the original gap down at $34. This type of chart where the gap is just starting to be filled has potential to be explosive. Especially since OTRK just hired a new CEO, Jonathan Mayhew. According to the SEC filing, Mayhew most recently served as Executive Vice President and Chief Transformation Officer of CVS Health, where he had enterprise-wide oversight of the entire portfolio of CVS business transformation initiatives and played a key role in shaping CVS Health’s integrated value story. Previously, he was President of U.S. Markets for the Aetna Health Care Business. Now OTRK has the connection to try to get the Aetna contract back.

LIVE remains a dark horse play. The short interest is low, but it doesn't really need short interest because of its extremely small float of only 1.27 million shares. KOSS has generally had a low short interest but that didn't stop the stock from running to over $100 from $10. LIVE's float is less than half of KOSS. Also LIVE is the only one in the group that has earnings and a P/E ratio. Most P/E ratios are around 20 so LIVE being at only 6 makes the stock nearly four times undervalued. We think it can reach $100 to come more in line with average P/E ratio numbers.

Comments

Post a Comment