The Next Short Squeeze Target - OTRK

OTRK is the next short squeeze target. The hedge funds are shorting this one heavily. The stock has dropped from $60 to under $25 in the last few days. A big deal is being made of the company losing their largest client but even with that loss, they still expect revenue to grow next year. Another thing you'll notice is a ton of news releases from ambulance chasing lawyers that are trying to create negative headlines. We think that some of these firms might be in bed with the hedge funds to try to put more negative sentiment on the stock and doubt into buyers' minds. This is a telltale sign of Wall Street trying to push it down to maximize short gains. After several red days in a row, it actually bounced quite nicely mid-day from less than $23, a sign that a bottom has been hit.

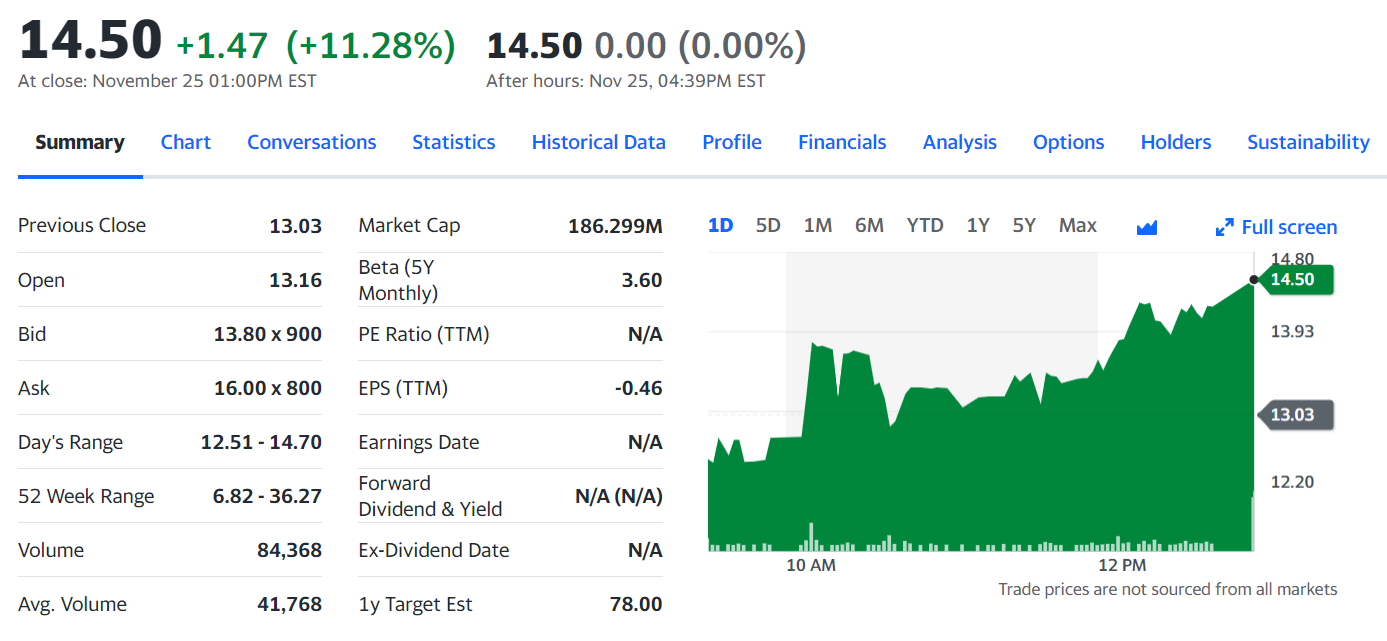

OTRK has a similar short interest as RKT, which has done very well on the back of a short squeeze lately. Look at the stats from Yahoo:

30.68% short interest. There is 7.23 million share float and 2.52 million shares short so that percentage is actually higher at around 35%. Keep in mind though that this data is only up to February 12. The stock has dropped from $85 since then. You'd think that shorts would cover at these prices, but no it's the opposite. Short volume has increased since then according to nakedshortreport.com:

In the days leading up to the 12th, short volume averaged 40%, in line with the short interest data we saw up to that point. Since then, and in the days leading up to the announcement, we see that short volume went as high as 74% and averaged 55%. The hedge funds obviously got word of some news leak. Now you would think that after the stock tanked and the news is out, those short positions would be closed and short volume would go down. But the average short volume over those past four days has been 52%, barely a drop from the days leading up to the news and much higher than the first part of the month.

The short interest as a percentage of the float could be over 50% right now. This makes a much better squeeze candidate than AMC and might be second only to GME. This stock could easily race back up on a short squeeze.

The pot stocks are all getting sborted too

ReplyDeleteHuge potential for this stock. The fundamentals are there. They lost a big client - but the foundation is solid. It's a bargain buy.

ReplyDeleteYou need to add $PPBT to this list...NT219 curing cancer in humans, Morgan Stanley purchased %5 of the company earlier this month, low float, Sabby's vulture fund shorting it to hell - would love to see this go into a gamma squeeze and obliterate the shorts. Who would short a potential cancer cure?

ReplyDelete