GETY & FAZE: Two SPAC Gamma Squeeze Candidates

GETY and FAZE are two excellent short and gamma squeeze candidates. Both of them were recent SPACs. Due to a high amount of redemptions, their floats are minuscule until each registers their S-1 and it becomes effective. This process takes several weeks after listing, and both are extremely unlikely to get approved before August 19, the data of options expiry.

FAZE has a 3.4 million share float. GETY has a 0.5 million float. Short interest as of July 29th shows just over 1 million for FAZE and 319,000 for GETY. Daily cost to borrow is in the several hundred percent, but shorts who keep an open position are willing to pay that as they are banking on each stock to sink back to $10 once the S-1s are effective. The problem with that is they do not control the timing of when the companies submit their S-1s and when they are deemed effective by the SEC. SPACs generally do have clauses in the PIPE and warrant agreements that state this needs to be done within 30 days of listing. But there is no guarantee that the SEC will deem these S-1s effective by then, plus the 30-day deadline is beyond option expiry for August for both companies so the point is moot anyways.

We have already established that short interest is very high for both stocks. But that alone won't be the driver for the gamma squeeze. It'll be the open interest on the call options. As call options go into the money, call option writers often buy the stock in order to hedge themselves from their negative call option position. This naturally causes a positive feedback cycle where buying increases the price, more call options go into the money at higher and higher strikes which then stimulates further buying to hedge against in-the-money calls.

Price action on both of these stocks indicate that this is starting to happen and there is a good chance of them going parabolic. Let's start with FAZE at it spiked over 40% on Tuesday before a 9% pullback on Wednesday. These are the call options up to $20 strikes for expiry at the end of this week and for the 19th:

There are 2,557 open interest on all the in-the-money strikes expiring on the 12th. There's an additional 2,100 in open interest at the $19 and $20 strikes. The gamma hedge of all of these options would eat up 465,700 in shares. Or about an additional 14% of the float.

But that just tells us one small piece of the story. The options expiring August 19th have much higher open interest. There are 11,643 in-the-money calls at $18 and below strikes. But there is an additional 5,753 open interest at the $20 strike plus significant open interest at strikes higher than $20. Hedging every strike at $20 and below would eat up a total of 1,739,600 shares, more than half the float. It should hopefully be clear to everyone reading this about the potential of the gamma squeeze given these conditions. The stock price violently rose to $21.99 today before its pullback, and it did so on only 2.9 million in volume. This is a great sign as retail buyers can have an outsized impact on the direction of the stock by either buying shares or call options while shorts have limited liquidity to draw on to close their position.

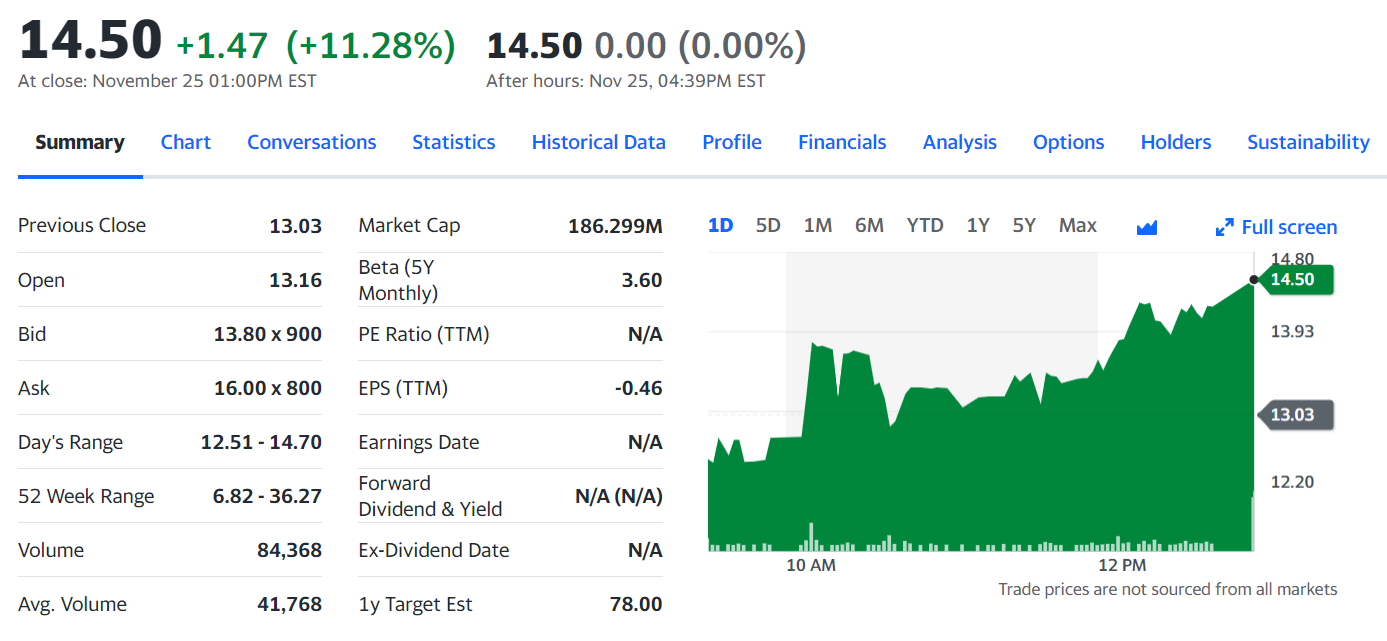

GETY has already had a spike of over 100% into the $30's recently. After a few days consolidating in the $20's, it looks ready to go for a second round. Here is GETY's open interest on options expiring on the 19th:

It's not as extensive as FAZE but with the much lower float it still does the trick. In-the-money calls at $25 or below have a combined 2,635 in open interest. There is an additional 7,564 in open interest between the $30 and $55 strikes, with the majority of that being at the $40 level. This is what can make the gamma squeeze so powerful. The in-the-money options eat up 263,500 of that 500,000 float, but the ones at higher strikes have the potential to eat up 756,400 more, greater than the float. The call option writers are playing a game with time. They are hoping the the S-1 becomes effective before option expiry, but that doesn't seem likely. Between writing calls and paying the massive daily cost-to-borrow, this can get pricey quick.

Option assignment and the gamma squeeze potential

There is one phenomenon that we are starting to see play out on both FAZE and GETY than will only accelerate the squeeze. And that is of early option assignment. Let's take the GETY August $17.50 strikes as an example. These options traded in a range of $8.20 to $9.25 on Wednesday. However, this stock spiked to a high of $28.44, implying a value of nearly $11 for the options. As the options are relatively illiquid, it's possible that it may have been valued this high on the bid-ask spread, but no trade actually took place. However, when comparing the stock's close of $26.89 and the ask of $9.50, this implies a $27 stock price, which is only 11 cents above the close on the ASK side of the call.

What we are trying to get at is, that these options trade at practically no time value and occasionally BELOW their intrinsic value. When that happens, an HFT bot would buy the call, sell the stock and pocket the difference. Let's use a similar example. Let's say GETY was $27.50 but the $17.50 calls at a $9.50 ask on them. The bots would pick up on that. Buy the call and short the stock. Exercise the call and pocket an immediate 50 cent difference. This example is extreme in order to easily illustrate the motive, but HFT bots will do this type of thing even for just a few pennies of arbitrage. As the call is being exercised right away, the call option writer gets assigned the short position generated from that call immediately. They then must either cover or face the consequences of holding a short position with cost-to-borrow so high and float so low. If they wrote a long-dated call option thinking that they would be safe, this is not true. Options with expiries for several months also have the ability to assigned right away, REALLY catching the option writer off guard.

FAZE and GETY shareholders should support each other

FAZE and GETY are brother stocks. Both of them are low float SPACs that went de-SPAC within a couple of days of each other. Both of them have a high gamma squeeze potential for the reasons mentioned above. In addition to that, both are very likely to be shorted by the same people. If a short gets a margin call on FAZE, they might have to close off their GETY short to cover off the margin, and vice versa. We saw that in the market the past two days. FAZE spiked to $21.99 and then GETY spiked to $28.44 before settling up 6% to $26.89. This was the best day it had this week after remaining flat around $25. The correlation isn't that strong yet but will get stronger as options expiry date of August 19 comes near. Imagine having a short position on GETY and FAZE at the same time both spike. It should become clear why you want to be in both stocks, and if you are in just one of the two positions, that you should still cheer for the other.

Comments

Post a Comment