February 1st trading on GME, AMC, EXPR, NAKD, KOSS, LIVE

Since the Wallstreetbets site is getting pretty crowded, we are going to use this blog as a place to store more DD.

GME - this was the lightest volume day since it popped over $100. The two sides are locked in. Longs are not selling but shorts are refusing the cover. The ones in the worst shape like Melvin have reported covered, though who knows if that's the truth until we see 13F filings. New shorts are coming in but keep in mind the waiting game puts longs at an advantage because borrow rates on the shorts are through the roof. Short interest is still over 100% of the float so it's impossible to cover at any price if longs hold and keep the price up. The media is trying to divide and conquer with AMC to try to get people's attention off of GME. Don't let it happen.

AMC - We've said before not to buy AMC, and today's trading should be evidence. It had 400 million volume yet even with all the buying it sunk all day after its initial pop and ended flat. AMC is not going to go anywhere because they are in bed with Goldman Sachs. Read this filing from last week:

https://www.sec.gov/Archives/edgar/data/1411579/000110465921006891/tm214013-1_424b5.htm

So if you buy AMC, you aren't screwing hedge funds shorting the stock, you're just helping Goldman Sachs make money. AMC has 45 million shares short. Well, the financing is for 50 million shares. That means shorts don't have to cover by buying your shares at a high price, they can just buy them off of Goldman at whatever price they set. Why do you want to support a company that doesn't care about you, that just wants to get money to pay management salaries and make Goldman Sachs money?

Compare that to GME which has a $100 million shelf offering out from December:

https://www.sec.gov/Archives/edgar/data/1326380/000119312520312805/d67321d424b5.htm

Even if they were to do a financing for the full $100 million, this is well less than a million shares. Not 50 million like AMC. Don't split money between GME and AMC. AMC doesn't deserve it based on these actions. If that 400 million in volume in AMC went to buy 20 million shares of GME instead, the stock probably would have hit $400 instead of going down to the $200's. AMC buyers just made Goldman Sachs and the hedge funds rich by buying AMC.

EXPR - if you must buy something other than GME, EXPR is a lot better choice than AMC. It dropped on 28 million shares, but considering the stock price is so low at $5, this amount of buying is not really much of a distraction to GME. EXPR has less shares short than AMC at 7 million or 13% of the float, but it also has no financing out. That means the only way for shorts to cover is to buy shares from people on the open market. It's not like the hedge funds can go to Goldman Sachs and ask for EXPR shares like they can for AMC shares.

LIVE and KOSS - these two are small float runners, instead of heavy short interest plays. KOSS already ran over $100 from less than $10 and LIVE can have the same potential from $28. LIVE was the best performing of this group today, up 8%. These two are okay because their floats are so small that putting a little bit of money here won't really impact your ability to buy and hold GME. KOSS ran over $100 on January 28th on only 11 million volume. LIVE has volume of less than a million and if it got to 10 million volume in a day it would probably run like KOSS too.

Live Ventures Incorporated is a mix between GME and KOSS. It has a business like GME and a float like KOSS.

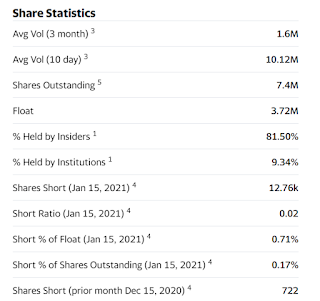

This is KOSS's share stats from Yahoo:

This is LIVE's share stats from Yahoo:

LIVE's float is actually much less than KOSS, 1.26 million versus 3.72 million. LIVE also has more short interest, 79.52K or 6% of the float versus KOSS with 12.76K or less than 1% of the float.

LIVE owns Vintage Stock. Vintage Stock is a retailer like GameStop that sells Music, Movies, Video Games, Comic Books, Posters, Toys and Sports Cards. It has about 60 locations across the southern United States.

LIVE also has really good financials, it has only an 8 PE ratio. Most companies have a PE ratio of 20 or more.

Can this one go to $1,000? Or at least $100. We think so.

Comments

Post a Comment