WSB Alert For Thursday Afternoon: Cheapest Bitcoin Miner Post COIN Public Offering - SPRT, MARA, RIOT, NCTY

COIN started trading yesterday. That's leading to the Bitcoin miners losing some steam despite Bitcoin remaining strong at over $62,000. We think that MARA, RIOT and NCTY are due for a big rebound. NCTY just raised $6.7 million at an ADS price of $24.81 to buy more Bitcoin mining machines, so the stock being under $20 is a great deal for buyers. The $20 call options expiring tomorrow offer the biggest high risk upside as well as the MARA $40 calls and RIOT $45 calls. We purchased all three call options this afternoon. A major run into the call options could cause a squeeze similar to the one we saw on GME leading into option expiry as option writers are forced to cover their position in-the-money tomorrow.

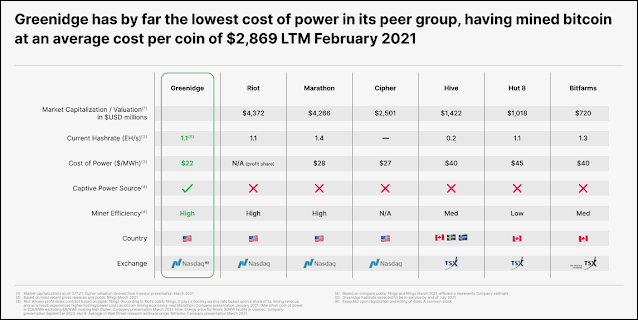

But one miner that is falling under the radar and has the greatest upside is SPRT. It should be trading in the $10 area to come in line with the other Bitcoin mining stocks. SPRT signed a deal to merge with Greenidge, a Bitcoin miner with its own source of power. The Greenidge presentation shows how it is comparable or superior to other top publicly traded Bitcoin miners out there:

There are two articles on Seeking Alpha about this deal, both of which calculate a 2-3x upside for SPRT just to come in line with RIOT's valuation once the merger with Greenidge is complete:

The first article includes this chart that clearly outlines a good argument for SPRT to be in the $10 range based on RIOT's market cap of around $4 billion.

Another stock to pay close attention to is NVCR, which rose 50% on Tuesday after the Data Monitoring Committee (DMC) recommended a reduced trial duration and patient numbers in its phase 3 trial for its Tumor Trial Fields treatment for non-small cell lung cancer. Tumor Treating Fields is a device that treats solid tumor cancers by using electro-fields to interrupt the cell division process that causes cancer to grow and spread. This is apparently working so well that the DMC said that it's unethical for patients in the control arm to continue to 18 months of follow-up and recommended a reduced sample size of 276 patients with 12 months of follow-up. It's better for these people to get the treatment rather than be part of the control group. This outstanding news means this stock is likely to be a multi-day runner and the device can probably apply to all sorts of cancers, making the potential market size in the many billions.

Comments

Post a Comment