AUUD And CUEN Are Headed For ALF-Like Short Squeezes - Buy The Warrants

We have written several blogs this month about our four top microcap short squeeze picks to try to take down notorious small cap manipulator Sabby Management, starting with the one on June 15th. They were Alfi, Inc. (ALF), BriaCell Therapeutics Corp. (BCTX) (BCT.V), 1847 Goedeker Inc. (GOED) and GeoVax Labs, Inc. (GOVX). Wallstreetbets censors DD on microcap stocks so we did our write ups here instead.

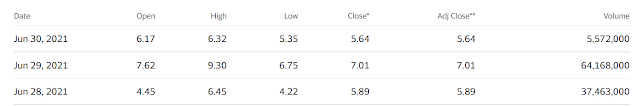

We all know what happened with ALF since then. We believe that Auddia Inc. (AUUD) and Cuentas Inc. (CUEN) are also headed towards ALF-like squeezes. Just like ALF, these two stocks are recent listings with warrants trading under the symbols AUUDW and CUENW. We have explained before that the short selling hedge funds use their inventory of warrants as insurance against their massive short manipulations of the stock. Today that was very obvious on CUEN and we will explain why later. But right now let's focus on AUUD as this is a very simple story to tell. This is AUUD's price and volume performance over the last three days:

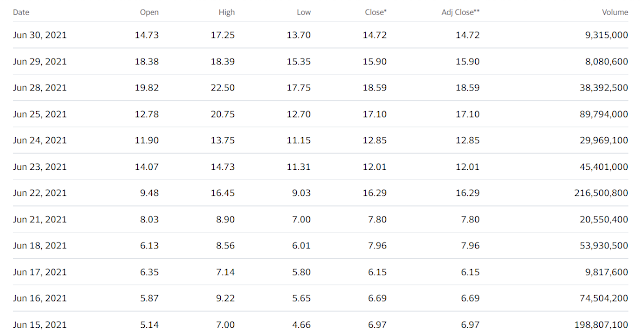

This is ALF's price performance over the last twelve days. Pay particular attention to the first three.

June 15 was the first day ALF broke out and closed above $5. June 28 was the first day AUUD broke out above $5. Here are the similarities to these two three-day sets:

1. Both day ones represented a break out on massive volume.

2. While day two had volumes going in opposite directions, day three saw a substantial decline in volume versus the prior two days.

3. Both hit a day high above $9 before pulling back significantly on day two.

4. Both day threes had a gap down from day two's close and finished off about 30 cents from the day low.

5. Both stocks closed day three at a lower price than day one.

Looking at these numbers we can see a very similar pattern between these two stocks. Bears thought that ALF would go down too but we stood by for the squeeze that we knew was going to happen. How could we tell? By the performance of the warrants.

Warrants are like call options that allow warrant holders to buy a company's stock at the strike price. The warrants should therefore follow the stock price less the strike price, or its intrinsic value. Otherwise there is arbitrage. It's easiest just to give an example as illustration. Let's say a stock has warrants with a strike price of $5. The stock spikes to $10 but the warrants trade at only $3. An investor could short sell the stock at $10, buy the warrants at $3 and immediately exercise them for $5. They pay $8 in total to cover their $10 short, pocketing $2 in arbitrage.

Hedge fund shorts know this and will use warrants in this way in order to stimulate arbitrage buyers on the warrants and arbitrage (short) sellers on the stock. The additional shorting puts weakness back on the stock price and allows the hedge fund short to live another day. We saw this very obvious effect on ALF two weeks ago, particularly when it first spiked above $9 on June 16. We saw this carbon copy effect on AUUD yesterday. Knowing what happened to ALF the following days, we know these games can't last long and shorts will break down and be forced to cover.

AUUDW has a strike price of $4.54. The stock price reached a high of $9.30 on June 29. The warrants were worth $4.76 at the time. However, the day high on the warrants was only $3.79, about $1 below their intrinsic value. Now some of that gap can be explained by illiquidity on the warrants, but most of that is going to be due to the effect of hedge funds trying to get arbitrage players to short the stock and put downward pressure on it, relieving the pressure on their shorts.

CUEN and CUENW were an even more blatant and egregious attempt at this style of shorter manipulation today. CUEN had a day high of $9.25 and the warrants have a strike price of $4.30. Therefore the warrants had an intrinsic value of $4.95. But they traded at a day high of only $3.86. Throughout the day the warrants were often trading $1 below intrinsic value. For instance, when the stock was trading around $8, the warrants were in the low $3's or high $2's when they were actually worth $3.70. This was followed up shortly thereafter with the stock price immediately being hammered $0.50 to $1.00 in seconds. This was clear stop loss raiding and shorter manipulation in a desperate attempt to kill the momentum on the stock. It ended up working at the stock tanked to close at $6.22. But the hedge funds shorts have shown their hand and we know that the same problems for them on ALF exist on CUEN and AUUD as well. Problems for them mean benefits for retail investor longs who want to support these companies and cause a squeeze against these shorting scumbags.

Obvious question: Why would the funds want to sell the warrants if that's the tool they use as insurance to short the stock?

They wouldn't, not all of them necessarily. But if you read our previous pieces, they might not have a choice in a squeeze situation. The funds don't WANT to sell their warrants, but they will in times of desperation to put a lid on the stock's price. Warrants are sold below their intrinsic value so that investors took advantage of the arbitrage, selling or short selling the shares to try to put selling pressure on the stock price.

How do you combat shorter manipulation on these small cap stocks?

Simple. Buy up all the warrants so that they lose their insurance policy and might need to go on a covering spree. Even if these stocks go to $20, they can easily cover the short by exercising the warrants and paying $4.54 or $4.30 per share. They don't have to cover at $20. Take that option away from them by buying up the warrants and they will cover now in order to avoid the risk of having to cover at $20 like what happened with ALF. Some will cover sooner in order to minimize losses. Others won't be so lucky.

Comments

Post a Comment