SPACs Are The Next Meme Stocks - Buy The Warrants And Cause A Squeeze - HLBZW, OPAD.WS, IRNT.WS

Recently listed SPACs have been on fire. This trend started with IRNT and spread to a few others including OPAD and HLBZ. The smart thing to do would be to buy the warrants of these listings - IRNT.WS, OPAD.WS and HLBZW. The warrants all have a strike price of $11.50 and are trading significantly below intrinsic value for the case of HLBZ and IRNT. If you can only get into one, HLBZ is the one to get since it's the most undervalued of the lot and the opportunity for arbitrage profits will come soon.

A warrant is the right to buy the stock at a certain price called the strike price. The warrant should be priced at the stock price less the strike price plus some time value, just like a call option. When warrants are trading below their intrinsic value, there is easy arbitrage to be had. Let's give an example with HLBZ:

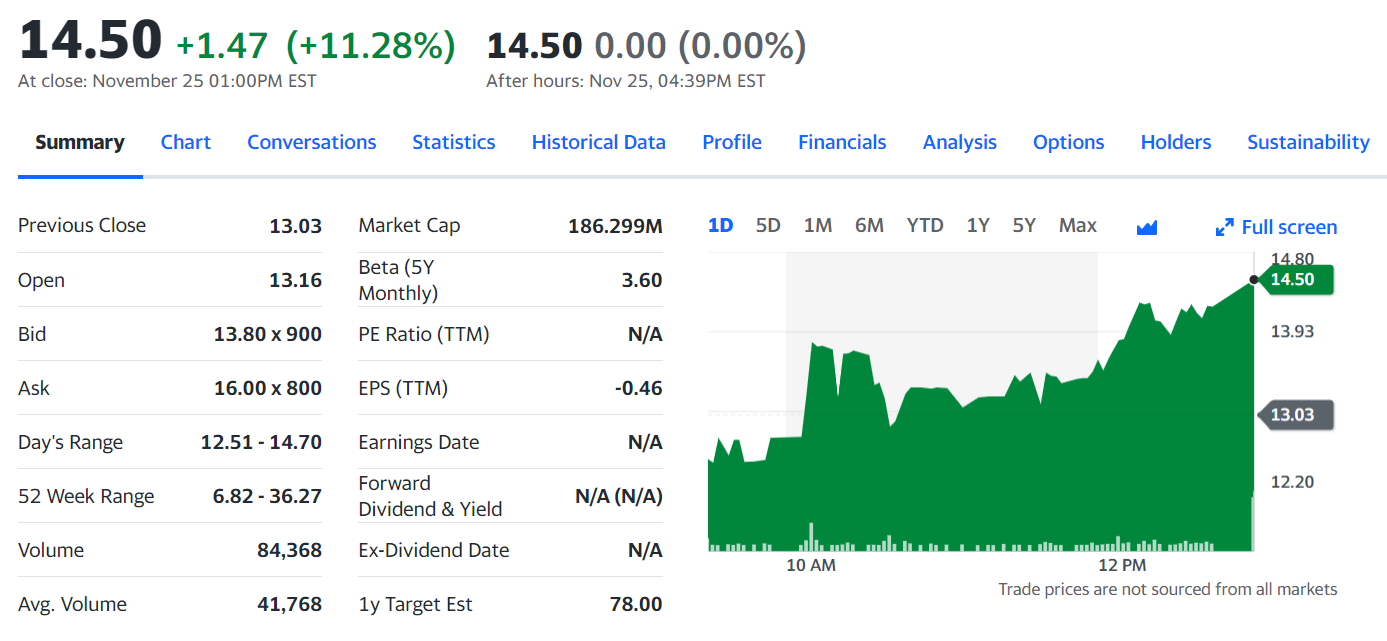

Stock price = $28.23

Warrant price = $2.31

Strike price = $11.50

If someone was to buy the warrants at $2.31 and then exercise them at $11.50 for stock, that would be the equivalent of paying of $13.81 for the stock. They could then sell this stock on the market for $28.23, making $14.42 in profits. In order for this arbitrage opportunity to be eliminated, the warrant should be worth $16.73 to come in line with this value. That's over 7 times upside.

IRNT also has the same opportunity with the stock price at $30.96 and the warrants at $7.70. The intrinsic value is $19.46 which is more than double than the warrant price. But relatively speaking, HLBZW is an even better deal.

Why aren't people exercising warrants and taking the arbitrage right now? Simple. The warrants aren't registered as effective by the SEC yet and can't be exercised until that's done. However, this will soon happen as the company has put out an S-1 filing to complete the process:

The SEC should deem this effective any day now. Once that happens, watch for the warrants to move up and the stock price to move down in order for this intrinsic value gap to come in line. The exact same thing happened to SPCE and numerous other SPACs before, where warrants holders made a lot of money if they sold quickly. The name of the game is to buy the warrants in the days leading up to effectiveness and sell or exercise them at a profit once the gap in price between the stock and warrants has reverted to $11.50. There's also the possibility that the stock price goes up, but even if it does so, the warrants go up that much more. If you want a position in HLBZ, the HLBZW warrants are what you want to buy.

There are only 2.65 million HLBZW warrants available, so buying up the warrants could cause a squeeze in their own right. Why? Hedge fund shorts use the warrants as insurance to mercilessly short the stock. This is also what is going on with OPAD and IRNT. All of these stocks have low floats and it's very hard and expensive to borrow shares to short. It poses a big risk to short them because they could conceivably go to $500 per share and the short becomes bankrupt. However, if a fund owns an inventory of warrants, this would act as an insurance policy. If a stock was to squeeze to $500, the shorter isn't the least bit worried because they can submit the warrants and $11.50 per share for new shares which they can then use to cover the position. It's a riskless bet to them, that's why they do it.

OPAD is a particularly obvious case. OPAD was up to $20 on September 16 on 111 million volume but has since dropped to $12.47 on lower volume in the days that followed. The stock has a very limited float of 3.27 million shares despite having over 200 million shares overall as most of that stock is still locked as part of the SPAC deal. But 20 million warrants are part of the $200 million PIPE. We see this poster on WSB lay out a wonderful bullish case on OPAD - but he forgot one thing - at least some of the warrants are free trading NOW, and the hedge funds can use them as insurance to mercilessly naked short the stock.

The end result was that OPAD's run was not sustained. If you want to cause a true short squeeze, BUY THE WARRANTS. Take out the inventory of the hedge funds while they are shorting the shares.

But why would hedge funds sell you their warrants? Easy. We called out this situation before on ALF's squeeze. They don't WANT to sell you their warrants, but they will in a desperate bid to keep the lid on the price. We said before a stock price could feasibly go to $500 and the hedge funds have no risk because they just cover submitting their warrants plus $11.50. But that's not 100% true. If the warrants aren't registered (note what we said about HLBZ's registration coming up soon) they can't immediately submit those warrants. They could be waiting for days or weeks meanwhile being exposed to outrageous borrow fees and margin call possibilities on the short position.

In an instance that a stock goes meme-stonk on them, they could be exposed. What they will do is sell their warrants to investors who take advantage of arbitrage deals who then short the stock and wait for registration to complete the arbitrage. These arbitrage players are likely other funds that have stronger positioning so they can wait it out without getting margin calls.

The original short funds don't WANT to sell their warrants, they HAVE to in a desperate attempt to get other funds to short the stock (those funds don't hate the stock, they just want the arbitrage) and put selling pressure on it. In the case of OPAD it worked because there 20 million warrants from the PIPE compared to the 3 million float. If you want to cause a squeeze on OPAD, buy up the warrants and eliminate the insurance policy of shorts and the arbitrage opportunity for those other funds. In order to cause a squeeze, the warrants as well as the stock and options need to be in retail control.

This goes for IRNT and HLBZ as well. Why let the hedge funds take on this easy arbitrage? This should be in retail control because they are in control of the meme stock. Arbitrage is one of the easiest and most lucrative financial opportunities out there. Let retail win for once. And retail can win big with HLBZ and IRNT warrants done properly.

For option players, there is another obvious reason why you want to buy OPAD.WS. Check out the April 2022 call prices on OPAD. The $12.50 strike price calls have a bid-ask of $2.75-$3.40. Meanwhile the warrants closed at $1.90 even though the strike price is $1.00 lower at $11.50 and it has four extra years to expiry. Don't buy the calls, buy the warrants. They are superior instruments and will cause the gamma squeeze because funds won't have them in their inventory to short stock any more.

The entire game in many of these spac shorts is from warrant holders. They will not be forced to sell their warrants at any price as that would be financial suicide. They own the warrants already. In IRNT, the borrow rate is now 1000%, the shorts plan on covering with their warrant shares within days or wouldn't be paying that rate

ReplyDeleteHLBZ warrants, even when registered, can’t be voluntarily exercised for months from now. Spring 2022. That’s why they haven’t and won’t come close to intrinsic value.

ReplyDelete