Carvana: The Gamma Squeeze Is Real

Heavily shorted Carvana Co. (CVNA) is in the middle of a squeeze. One that looks eerily similar to the beginnings of the one we saw on GME that eventually made it run to $400 and took down Melvin Capital. Once again certain market players or commentators who focus on fundamentals and who misunderstand or downplay the short squeeze thesis will only add fuel to the fire as they short the stock. Will Carvana be able to refinance its debts next year? Will it become profitable by then? Who knows, and who cares. 2024 isn't the timeline here. The timeline starts as early as June 16, 2023. Triple witching day on options.

The first thing to make note of is the general market. High beta and highly shorted listings (not in terms of percent of float, but in terms of number of shorts outstanding) like QQQ, TSLA and AMZN are hitting year or multi-month highs. This is causing pain and margin call pressure to shorts. This is important because the entities that are likely to short CVNA would also be shorting other things like these big name high-beta listings. They are getting relief from nowhere.

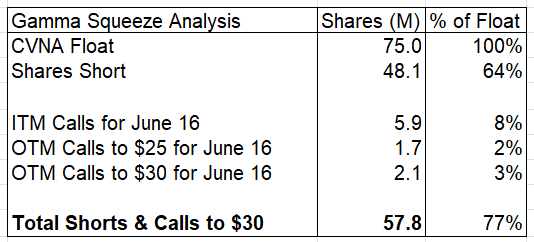

CVNA broke out in a mini-squeeze last week when it spiked to over $27 from $15 after announcing improved margins for Q2. That certainly sparked some short covering, but with 48 million shorts or about 64% short interest, this is far from done. The stock has high potential to gamma squeeze given the insane amount of open call options positions there is right now. A total of 59,105 open interest on call options exist that are in the money at strike prices of $21.00 or below expiring at the end of this week. That represents 5.9 million shares potentially locked up in gamma hedging strategies and must be presented by call option writers to settle the positions. Close to 20,000 of call option open interest went in-the-money today as the stock price rose from $19.07 to $21.26. There is an additional 17,397 in open interest on call options up to a $25 strike price and another 20,888 in open interest on call options ranging from $25.50 to $30. The gamma squeeze opportunity is highlighted here:

48 million shares are short. But an additional 6 million need to be presented to close out in-the-money call option positions with an additional 4 million that might need to be presented should the stock reach $30 by the end of the week. These numbers will most certainly change over the next four days, but there is a good chance that they will only increase. This doesn't account for the tens of thousands of call options that are currently in-the-money at later expiration dates that would have shares locked up in gamma hedging strategies. The potential of a gamma squeeze on Carvana is real.

Comments

Post a Comment