The Three Stocks Winning Alongside The GME Squeeze

This morning GameStop Corp. (GME) has been on fire as Roaring Kitty has returned. Stocks like Koss Corporation (KOSS), BlackBerry Limited (BB) and most notably AMC Entertainment Holdings, Inc. (AMC) are up in sympathy, though they have given up a lot of their gains.

What people need to realize is that short squeezes are all connected. There are three stocks right now that are moving up as part of the GME squeeze that are under-the-radar but are certainly correlated.

The first and most obvious one is ImmunityBio, Inc. (IBRX). It was quiet at first, but shortly after GME broke $30, it moved 5% to around $8.50 and sits near its day high at the time of this write up.

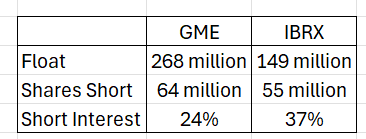

When we compare the stats of GME to IBRX, they are very similar, with IBRX having a slight advantage.

As the shorts capitulate on GME, look for IBRX to follow.

The second one is Dave Inc. (DAVE), which has a very similar 5% spike once GME broke $30:

DAVE last week had strong earnings which drove the stock price up and has a CVNA-like chart. The stock has 700,000 shorts on a 7 million float. This is like a "KOSS" play. Lower short interest, but because the volume and float is so small, it has as good of a chance for a wild spike as anything.

Third is Innodata Inc. (INOD), which like the other two, has a spike once GME broke $30:

Like DAVE, it has very strong earnings which lifted it up last week, and shorts are in a bind. There are 3.6 million shares short on a 27 million float for a 13% short interest.

The correlation between all three of these stocks once GME broke $30 is key. Shorts are getting a beat down today. These three stocks have a chance to benefit with a massive run like GME has had.

Comments

Post a Comment